Family Hsa Limit 2024

Family Hsa Limit 2024. Hsa contribution limits for 2024. For 2024, the hsa contribution limit for individual coverage increases to $4,150, and the family plan cap goes up to $8,300.

The changes will also affect what constitutes an hdhp. Hsa contribution limits for 2024.

This Is Up From $3,850,.

Plan management | health savings account.

The Changes Will Also Affect What Constitutes An Hdhp.

Hsas are a type of account you can open if you have a health insurance deductible above a certain threshold — $1,600 for individuals in 2024.

The New 2024 Hsa Contribution Limit Is $4,150 If You Are Single—A 7.8% Increase From The Maximum Contribution Limit Of $3,850 In 2023.

For 2024, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual.

Images References :

Source: www.cbiz.com

Source: www.cbiz.com

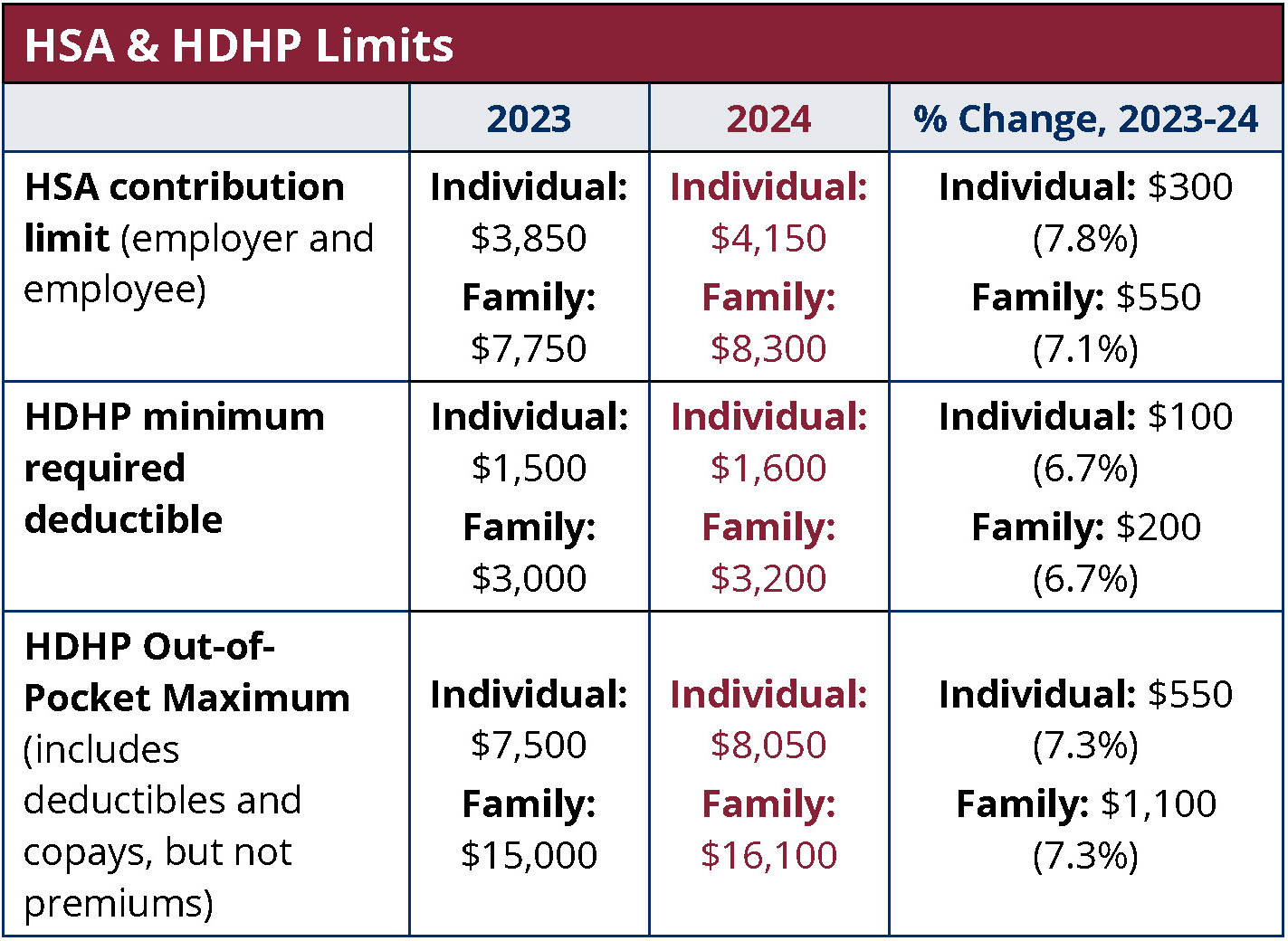

2024 HSA & HDHP Limits, For 2024, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual. Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, This is helpful because there is a limit on how much can be contributed each tax year. Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Source: www.medben.com

Source: www.medben.com

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, For 2024, the hsa contribution limit for individual coverage increases to $4,150, and the family plan cap goes up to $8,300. For 2024, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual.

Source: www.claremontcompanies.com

Source: www.claremontcompanies.com

2024 HSA Contribution Limits Claremont Insurance Services, Hsa contribution limits for 2024. Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families.

Source: medcombenefits.com

Source: medcombenefits.com

IRS Announces 2023 HSA Limits Blog Benefits, For 2024, the contribution limits increase again, allowing you to save up to the following amounts: In may, the irs announced a significant increase to the annual hsa contribution limit for 2024.

Source: www.payrollpartners.com

Source: www.payrollpartners.com

IRS Announces HSA Limits for 2024, Deductible of at least $1,600, maximum out of pocket costs of $8,050. This is up from $3,850,.

Source: paysmartpa.com

Source: paysmartpa.com

IRS Announces HSA Limits for 2024 Paysmart, Eligible taxpayers can contribute up to $4,150 to self. Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families.

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2024 HSA Contribution Limits First, For 2024, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual. Annual hsa contribution limits for 2024 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Source: padmin.com

Source: padmin.com

IRS Releases HSA Limits for 2024 P&A Group, The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. Plus, participants who are age 55 and older.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, Hsa contribution limits for an individual with family coverage: You have until april 15, 2024, to make contributions to your hsa for 2023, up to the applicable annual limit.

Annual Hsa Contribution Limits For 2024 Are Increasing In One Of The Biggest Jumps In Recent Years, The Irs Announced May 16:

What are the hsa contribution limits for 2024?

Hsa Contribution Limits For 2023 Are $3,850 For Singles And $7,750 For Families.

In may, the irs announced a significant increase to the annual hsa contribution limit for 2024.

For 2024, Individuals Can Contribute A Maximum Of $4,150 To An Hsa.

In 2024, health plans will qualify for.

Category: 2024