Irs Donation Values 2024

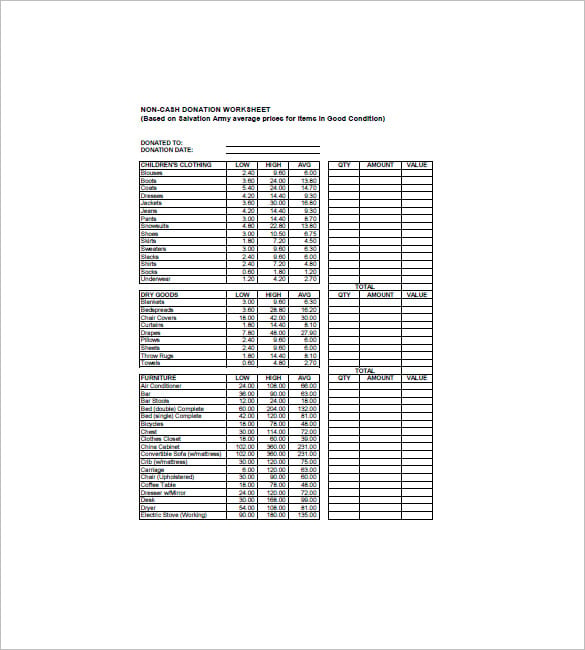

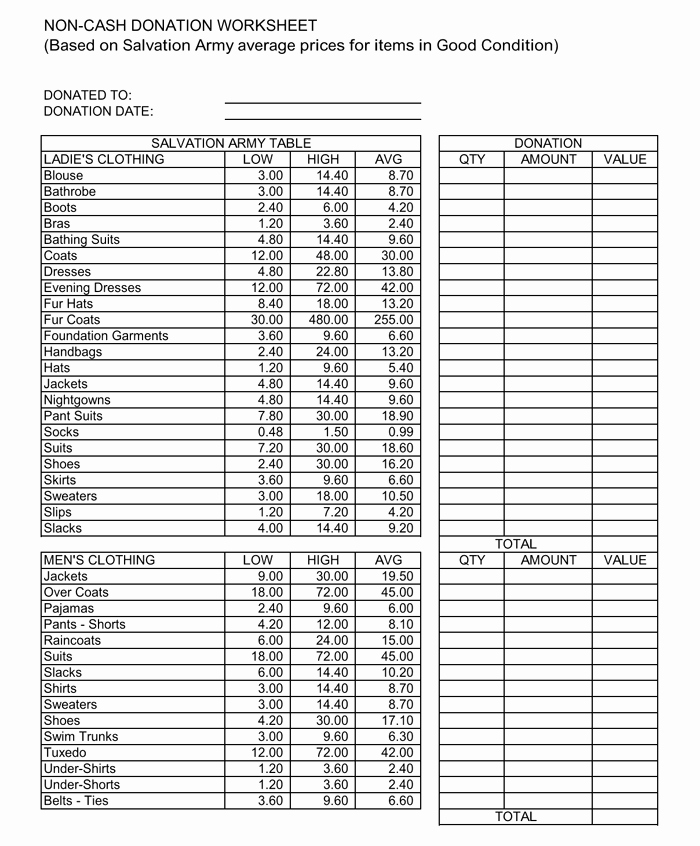

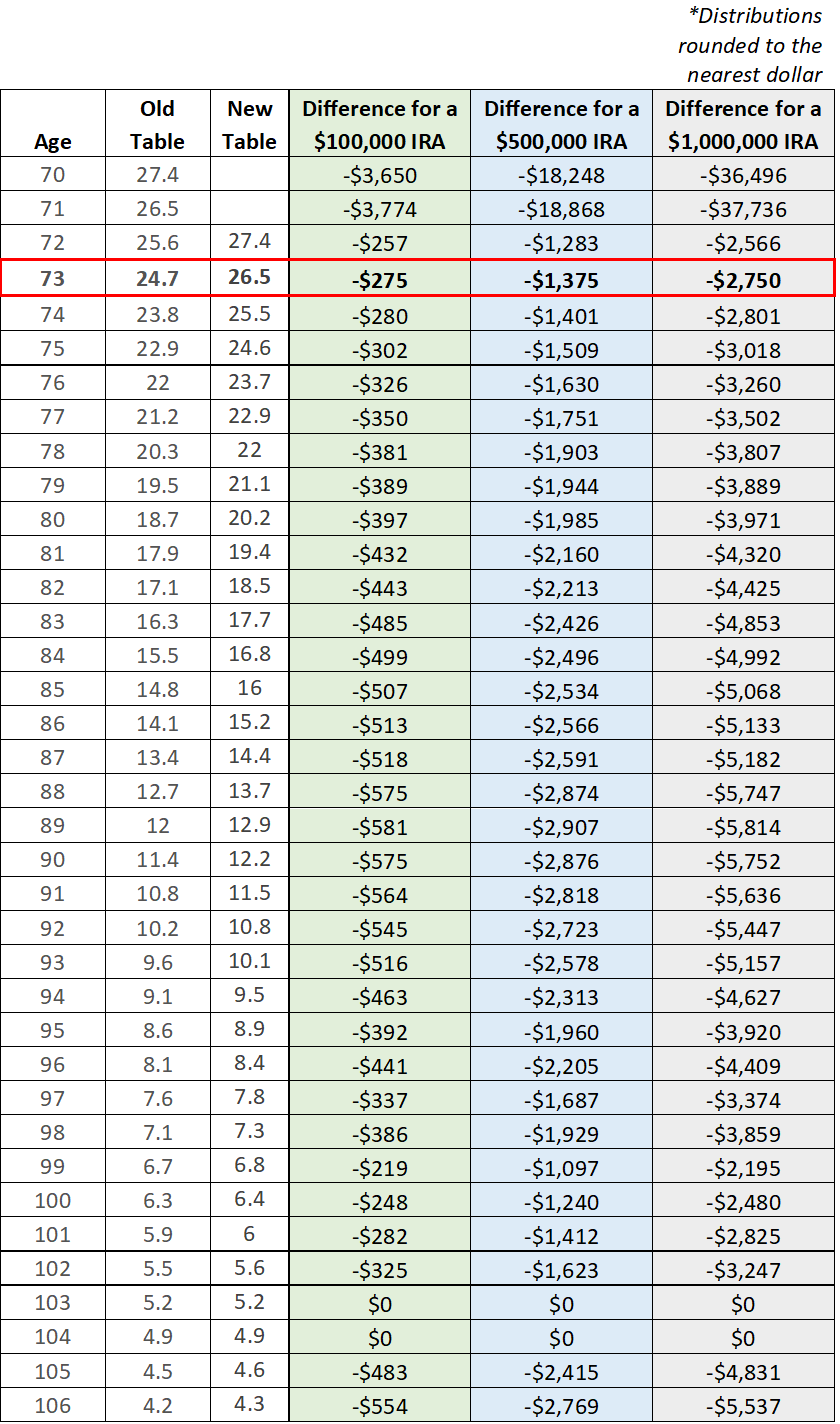

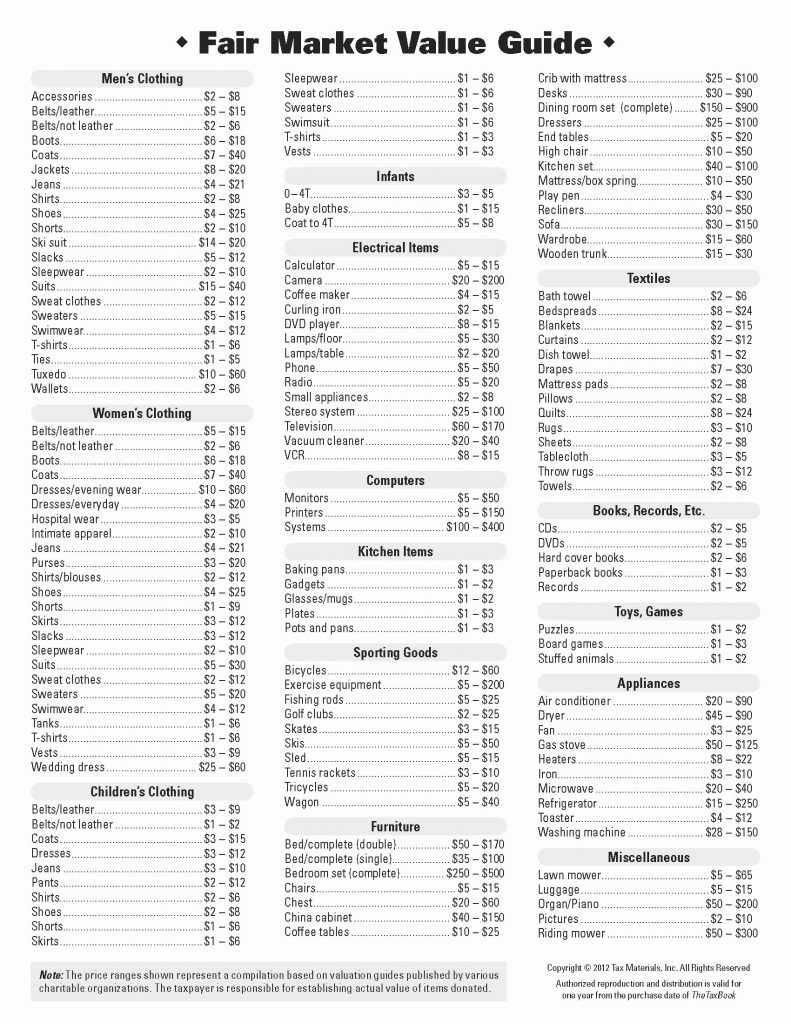

Irs Donation Values 2024. Washington — the internal revenue service reminds individual retirement arrangement (ira) owners age 70½ and older that they can make up to $105,000. The tax deduction you receive for donations to charities is based on the fair market values of the items donated.

Read on as we walk you through questions such as “what is a charitable donation?”,. It includes low and high estimates.

Irs Donation Values 2024 Images References :

Source: elwirayroselle.pages.dev

Source: elwirayroselle.pages.dev

Irs Donation Values 2024 Alexi Madelaine, It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct.

Source: bonnyysheelah.pages.dev

Source: bonnyysheelah.pages.dev

Irs Donation Values 2024 Agnese Charlotta, New federal income tax regulations require donors claiming deductions for charitable contributions consisting of property other than cash worth more than $500 to file internal.

Source: lessonlistvasculums.z14.web.core.windows.net

Source: lessonlistvasculums.z14.web.core.windows.net

Donation Value Guide Calculator 2024, It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct.

Source: lorrainewlexie.pages.dev

Source: lorrainewlexie.pages.dev

Donation Value Guide 2024 Magdaia, As i recently mentioned in my blog, i believe one of our jobs as advocates is to see.

Source: printablegitarie1.z14.web.core.windows.net

Source: printablegitarie1.z14.web.core.windows.net

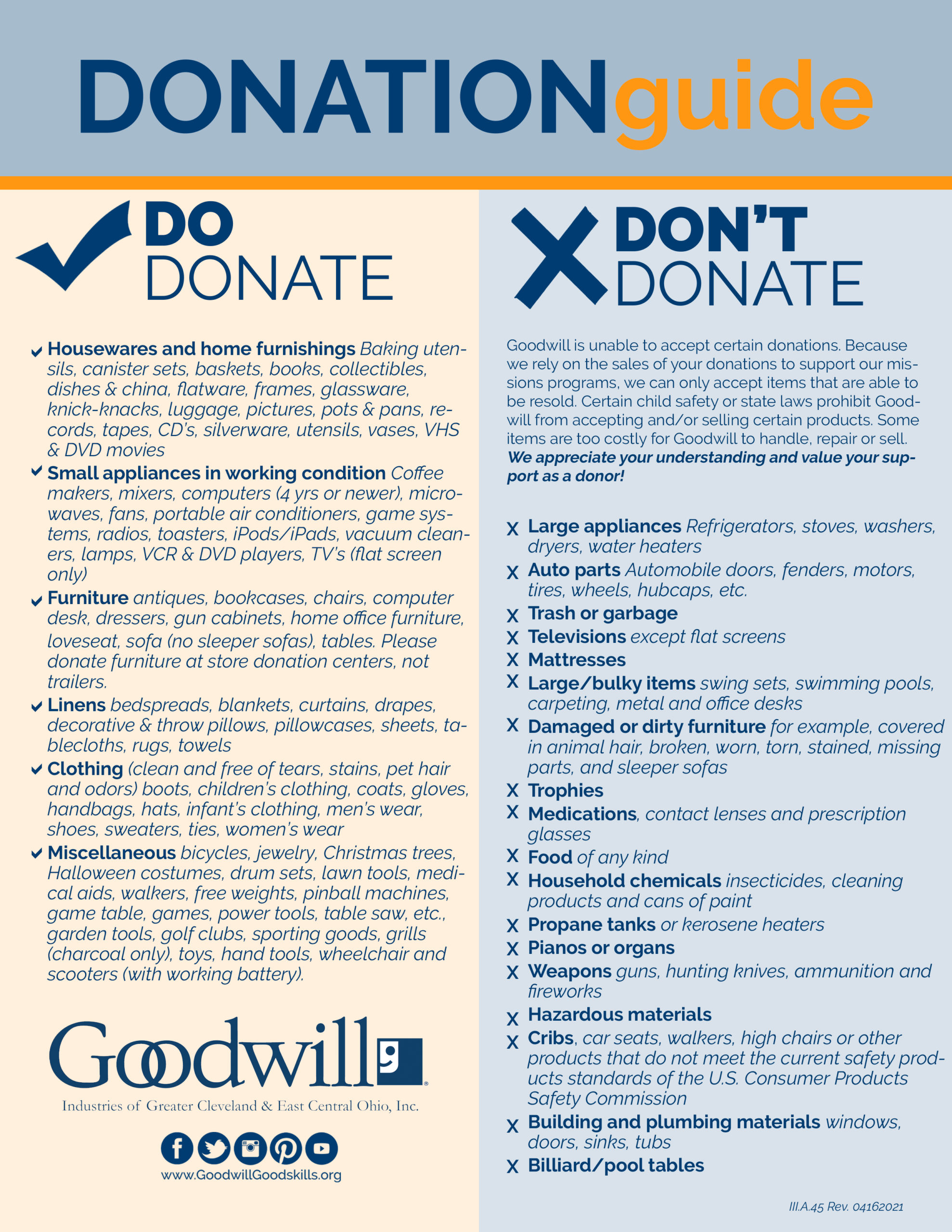

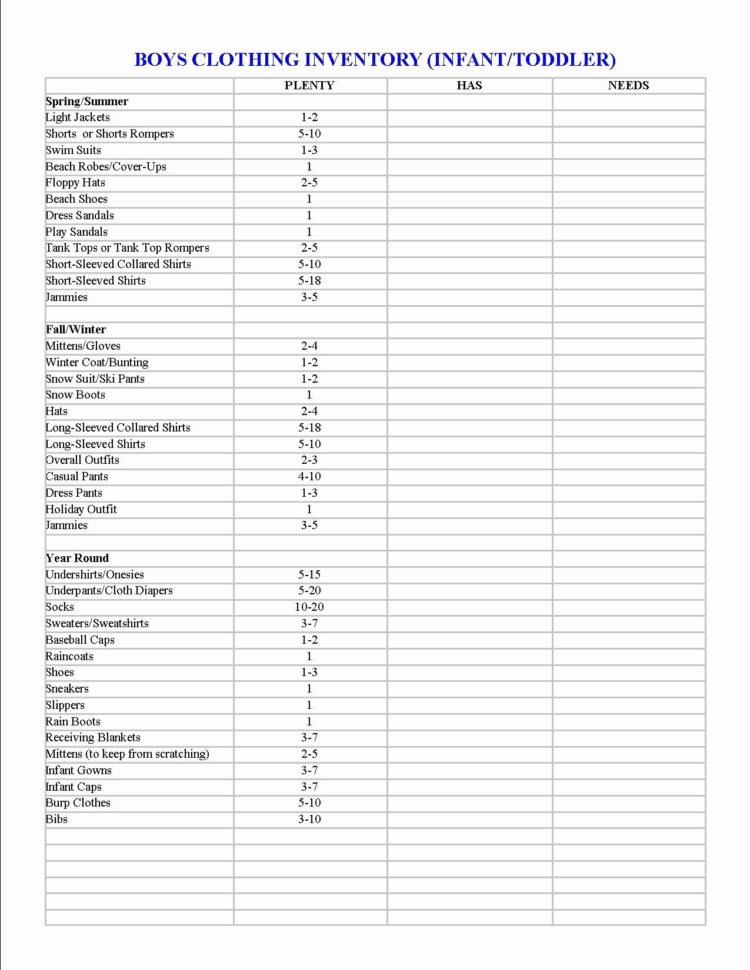

Goodwill Itemized Donation List Printable, Donations of items should be valued at their fair market value when calculating the deduction on your tax return.

Source: charlotwcollie.pages.dev

Source: charlotwcollie.pages.dev

Irs Life Expectancy Table 2024 Pdf Irina Leonora, Learn what records to keep and how to report contributions;

Source: lessonfulluntrusses.z21.web.core.windows.net

Source: lessonfulluntrusses.z21.web.core.windows.net

Donation Values For Clothing, Donated clothing and other household goods must be “in good used condition or better,” according to the irs charitable contribution guide.

Source: db-excel.com

Source: db-excel.com

Irs Donation Values Spreadsheet Printable Spreadshee irs donation value, Your donation funds reporters who cover local issues and allows us to keep.

Source: elwirayroselle.pages.dev

Source: elwirayroselle.pages.dev

Irs Donation Values 2024 Alexi Madelaine, Internal revenue service (irs) requires you to value your donation when filing your return.

Source: www.aditi.du.ac.in

Source: www.aditi.du.ac.in

Irs Donation Value Guide Fill Online, Printable, Fillable,, 05/10/2024, It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct.